Immediately after starting an account, you will need to render some personal information accomplish the brand new application process. Credit Karma requires info just like your full name, go out of beginning, and you will social safeguards amount.

Giving Permission getting Credit history Availableness

You are questioned to offer Credit Karma consent to gain access to the credit reports from TransUnion and you can Equifax https://clickcashadvance.com/installment-loans-wv/prince/ included in the application techniques. That is critical for Borrowing Karma to provide perfect credit ratings and individualized pointers considering their credit profile. Giving permission lets Borrowing Karma so you’re able to retrieve your credit recommendations securely and you can effortlessly.

When you over such measures, you’ll efficiently get Borrowing from the bank Karma qualities. It is important to observe that Borrowing from the bank Karma’s properties was topic in order to eligibility requirements, rather than all pages may be qualified to receive certain has. not, Borrowing Karma’s associate-amicable platform makes it simple for folks to access and you can create their monetary information to attain its goals.

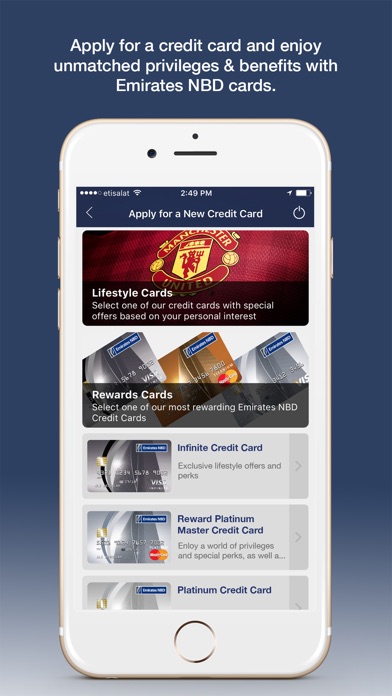

The latest Credi Karma Software

The credit Karma app can be obtained for Ios & android and try a highly smoother answer to place your pointers at your fingers. You could quickly access your credit score to check out any latest transform.

You have access to label and credit keeping track of; your Credit Karma Help save and Pend membership, offers, economic calculators, blogs and appear through the application.

Acceptance Potential and you can Limits

While using the Borrowing Karma, it is essential to see the characteristics of recognition possibility and also the limitations on the all of them. Recognition possibility provided with Borrowing from the bank Karma shall be considered an imagine rather than a guarantee regarding recognition for any financial unit otherwise solution.

The kind regarding Recognition Chances

Recognition chances are high dependent on taking a look at facts eg credit history, income, and you can debt-to-income proportion. Such its likely that calculated predicated on analysis wanted to Borrowing Karma by the loan providers as they are supposed to provide pages a concept of their probability of recognition.

Factors Affecting Approval Chance

Numerous affairs normally dictate recognition potential, plus credit score, payment record, credit usage, plus the particular requirements of the financial. You should remember that per lender possesses its own criteria getting determining approval, that standards can vary somewhat.

Credit score

Your credit score performs a crucial role within the deciding your approval potential. Generally, a top credit history expands your chances of approval, if you’re a lesser credit rating can result in lower potential.

Commission History

Having a history of towards the-go out payments normally definitely feeling your recognition chances. Loan providers prefer borrowers who possess exhibited in control fee choices regarding the earlier in the day.

Borrowing from the bank Use

Loan providers and be the cause of the borrowing utilization ratio, the portion of readily available borrowing that you will be currently playing with. Keeping your borrowing usage reasonable can also be alter your approval opportunity.

Bank Criteria

Each lender sets its very own conditions to own approval, that could are minimum income accounts, work background, otherwise specific credit score thresholds. It’s required to comment such requirements before applying for your economic equipment.

Skills Artificial Photographs

Inside the Borrowing from the bank Karma application, you can also come across artificial photo portraying possible has the benefit of otherwise loan terminology. This type of images is made to own illustrative motives just and don’t show actual has the benefit of. They are designed to provide profiles an artwork image and ought to never be misleading given that genuine-go out or secured offers.

It’s important to keep in mind that these simulated photos should update and you will teach users concerning the choices they could find. The fresh new words while offering obtained may vary based on personal activities and you may bank conditions.

The bottom line is, if you’re Borrowing Karma’s recognition potential also provide beneficial knowledge into your probability of acceptance, they want to not regarded as decisive pledges. It’s imperative to check out the numerous issues that determine approval, opinion lender requirements, and work out told decisions centered on your unique financial reputation.

No comment yet, add your voice below!